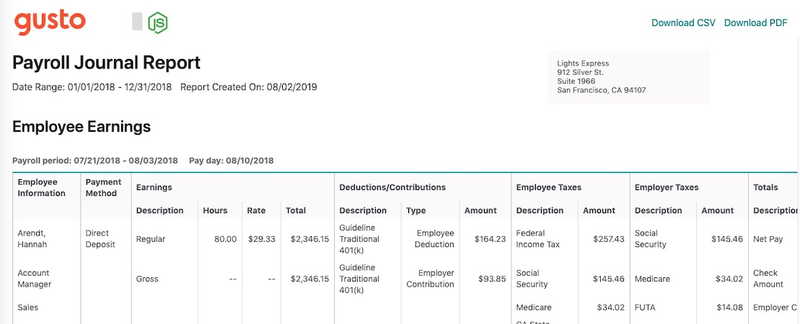

Click the “View/Pay” button, which brings up the liability check.In the “Payroll Center”, select “Pay Taxes Liabilities and Liabilities” and select “Pay Liabilities” tab then select the overdue liability that was paid via “Write Checks” or “Bill Payment”.Note the amount paid and the expense account used. Find the incorrectly recorded payroll liability payment transactions.If you find that a payroll tax liability was paid using the “Write Checks” screen (or a Bill and Bill Payment), after you determine the account when the original entries were posted, you can fix the problem by following these steps: Verify that this transaction was created to pay payroll tax liabilities.If there is a check or bill, double click to view the transaction. All payroll tax liability payments should be listed as a “Liability Check”.Review all transactions related to this vendor in the right-hand pane and ensure that all transaction types are displayed.Find the payroll tax agency and click on that vendor’s name.In all likelihood, you will see at least one check or bill transaction.Īlso, look at the payroll tax agency in the “Vendor Center” to see if the liability was paid with “Write Checks” by doing the following: Look at all the transactions in the Payroll Liabilities account to see what type of transactions were used in the past to pay payroll liabilities.

QUICKBOOKS DESKTOP PAYROLL REGISTER SOFTWARE

Also the quarterly payroll forms will show an incorrect balance due, despite the fact that the balance for this account in the Balance Sheet is correct. We ranked QuickBooks Payroll the best payroll software and in this QuickBooks Payroll review, we take a closer look at what it can do. Incorrectly entered payroll tax liability payments are suspected when you try to pay payroll liabilities using the correct workflow, but the “Pay Liabilities” window shows prior period payments as overdue (in red). Quickbooks training? Call LSL CPAs – (714) 569-1000

0 kommentar(er)

0 kommentar(er)